The Future of Private Practice: Shift to Private Pay?

Key Insights from the 2025 Mental Health Insurance Report

A new report, the 2025 Mental Health Insurance Report was released about private practice business models from Beacon Media + Marketing and Thrizer, reveals significant shifts in how therapists are charging clients.

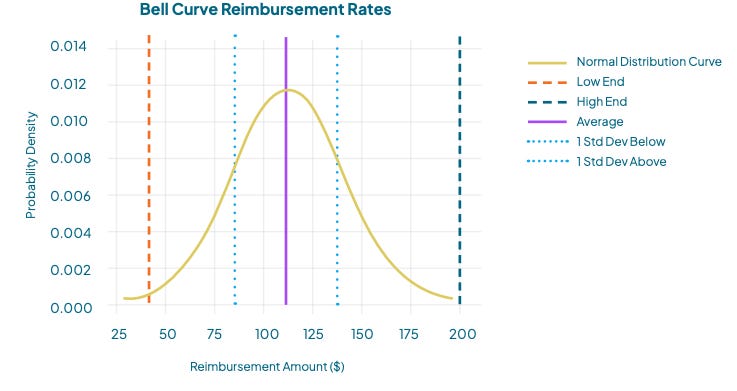

That’s because average insurance reimbursement rates are about $112 per session falling well below the desired $180-$200 range that many therapists are charging in private pay.

The survey was conducted from 317 individual responses including social workers (30%), professional counselors (28%), mental health counselors (15%), marriage and family therapists (14%), and psychologists and psychiatrists (13%).

The data from the report presents a clear trend: therapists are increasingly questioning the viability of insurance panels. Only 53% of surveyed practitioners consider insurance participation worthwhile, and 54% plan to leave panels within the next year.

No doubt the financial mathematics are compelling many to reconsider their business model and if they should continue to take insurance.

In addition, administrative challenges further compound these financial considerations. More than half of practitioners report experiencing denied claims, while 27% faced insurance clawbacks. These administrative burdens represent significant costs in time and resources.

The Private Pay Alternative

The transition to private pay emerges as an increasingly attractive option, according to the report. Current private pay rates average $174 per session, with $150 being the most common rate. While this falls short of ideal rates, it represents a substantial improvement over the $112 insurance reimbursement rates.

The primary motivations for transitioning to private pay include financial sustainability (34%), reduced administrative burden (26%), enhanced clinical autonomy (20%), improved work-life balance (13%), and frustration with insurance systems (8%). These factors suggest the shift toward private pay reflects both business and quality-of-care considerations.

Marketing Insights and Opportunities

Perhaps most revealing are the report's marketing findings. While therapist directories (85%) and professional referrals (79%) dominate client acquisition channels, digital marketing remains surprisingly underutilized. Only 27% engage in SEO and blogging, 15% use social media marketing, and 13% employ Google Ads.

Furthermore, 88% of practices invest less than $400 monthly in marketing, suggesting significant room for competitive advantage. This investment level may reflect uncertainty about effective marketing strategies or concern about return on investment.

Strategic Implications for Your Practice

These findings suggest several strategic considerations for private practitioners:

Evaluate your insurance panel participation through the lens of both financial and administrative costs. Consider whether a hybrid model might offer a transition path to private pay while maintaining accessibility.

Assess your marketing investment. The widespread underinvestment in marketing suggests opportunity for practices willing to develop more sophisticated client acquisition strategies.

Consider your rate structure. With actual private pay rates averaging $174, there may be room to adjust rates while remaining competitive, particularly if you can articulate clear value propositions to potential clients.

With everything happening in technology and AI, the mental health private practice landscape is clearly evolving rapidly. Successful practices will likely depend on making informed strategic decisions about business models, marketing approaches, and pricing structures including whether to fully embrace private pay in the future.